Millennials are increasingly moving money into exchange traded funds while shedding some of their earlier enthusiasm for speculative digital assets, according to market data and recent surveys. Investors born between 1981 and 1996 appear to be pivoting toward instruments that combine low cost broad market exposure with the liquidity and ease of trading that younger investors value. Meanwhile sentiment toward cryptocurrency has cooled among the broader public even as a core group of dedicated crypto holders remains active. Together these trends are reshaping retail flows and the products asset managers are racing to offer.

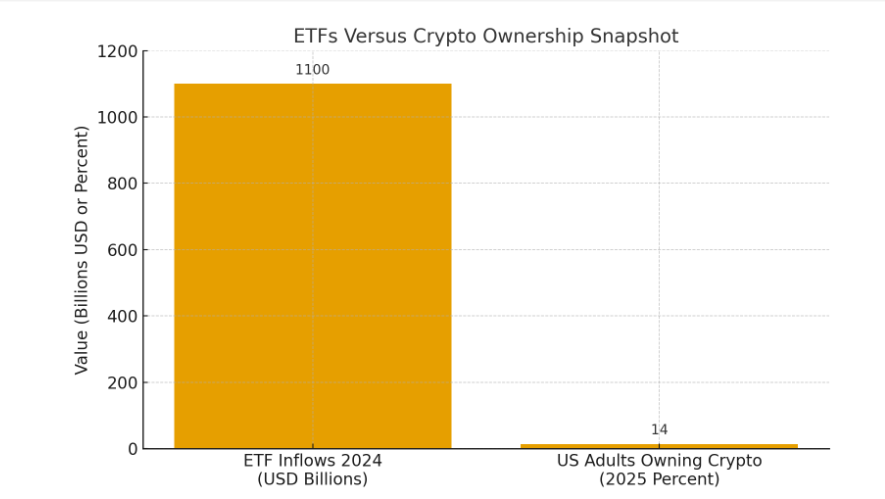

To begin with, exchange traded funds posted record inflows in 2024, underscoring how mainstream ETFs have become as a vehicle for both long term savings and tactical exposure. Industry tallies show that ETF flows topped roughly 1.1 trillion US dollars in 2024 and equity ETFs accounted for the bulk of that demand. This surge in ETF demand has been led by large index trackers but also includes a growing share allocated to actively managed and thematic ETFs.

READ MORE: Deloitte Recruitment (November 2025): Open Jobs / Online Application

Concurrently, surveys and industry studies point to a distinct generational tilt. Large scale ETF studies from major providers found that a significant majority of millennials now hold or are interested in ETFs and alternatives, with some reports indicating that roughly two thirds of millennials report using ETFs in their portfolios or expressing interest in alternative exchange traded products. This appetite is reflected in product innovation and the entry of more active managers into the ETF space.

There are several reasons for the shift. First, ETFs offer a transparent low cost route to diversified holdings. Second, the trading model matches how younger investors already interact with markets through brokerage apps. Third, regulatory clarity and the expansion of spot commodity and sector ETFs in recent years have created choices that were not widely available a handful of years ago. As a result asset managers and advisors report increasing allocations to ETFs when designing millennial oriented portfolios.

At the same time the percentage of the general population that owns cryptocurrency remains relatively modest, and some surveys show signs of cooling interest. Recent national polls measuring crypto ownership and general consumer sentiment indicate a minority share of adults actually hold crypto assets, and many citizens express limited interest in buying. In that context crypto is seen by many as a niche allocation rather than a core savings vehicle for retirement or emergency funds.

READ MORE: Apple, Microsoft Drive Market Gains Amid Strong Earnings

Nevertheless the crypto cohort has not vanished. Industry surveys from exchanges and custodians report that a committed segment of investors continues to plan further crypto purchases and to treat digital assets as a strategic component of a diversified portfolio. Those investors often skew younger and male and they frequently combine crypto exposure with other risk on holdings rather than relying on crypto alone. Thus the picture is nuanced. On the one hand broad public interest is muted; on the other hand dedicated crypto communities remain active and influential.

Market participants quoted in recent coverage point to risk management and practical portfolio goals as reasons millennials are leaning into ETFs. One asset manager said millennials prefer instruments that are straightforward to explain and to maintain. Another strategist noted that the increased use of AI driven advisors and robo platforms is steering new investors toward low cost diversified vehicles that can be monitored automatically. These remarks reflect a broader industry view that the technology used to access markets is changing investor behavior as much as product innovation is.

READ MORE: US GDP Growth Beats Expectations, Fueling Rate-Cut Debate

There are also macro level drivers. After a decade of central bank and fiscal policy shifts, many young investors have watched markets experience both dramatic rallies and sudden drawdowns. That memory encourages a tilt toward products that spread risk across many securities. Additionally, employers and retirement plan sponsors have been adding ETF based options that make it easier for younger workers to allocate into market baskets with low friction. Transitioning capital from direct ownership of single equities or speculative tokens into diversified ETFs can be a natural step for risk conscious savers focused on long term goals.

Importantly, the move toward ETFs does not eliminate speculation. Millennials remain active in trading single stocks and in allocating small portions of portfolios to higher risk ideas. Yet the marginal flows indicate a rotation in where new savings are placed. As ETFs broaden their range of exposures including more thematic and alternative strategies, they are capturing both core savings flows and the interest of investors who want specialized access without concentrated idiosyncratic risk.

Looking ahead the competition for retail dollars will likely intensify. Asset managers will design ETFs that meet millennial preferences for cost transparency simplicity and alignment with values such as sustainability. Brokerage platforms will continue to innovate how young investors discover and route capital. Regulators will watch these shifts closely to ensure retail protections keep pace with new product complexity.

In short, millennials are showing a measurable reallocation toward ETFs even while a committed crypto cohort remains active. Because ETFs combine liquidity low cost exposure and an expanding menu of strategies they are well placed to capture the next wave of retail investment. Meanwhile sentiment data on crypto points to a more selective and experience driven ownership pattern rather than a broad based adoption among the general public.

READ MORE: Global Stocks Edge Higher as Investors Await Central Bank Decisions