Apple and Microsoft led Wall Street higher this week as robust earnings expectations and upbeat sales figures sent investors pouring into megacap technology names, lifting major indexes and reinforcing optimism about the market outlook. In particular, Apple surged on strong early iPhone demand while Microsoft drew attention for its cloud and artificial intelligence momentum, and together the two tech giants pushed market capitalization milestones that underscored how earnings and product cycles continue to drive broad market gains.

Investors rewarded results and forecasts that beat consensus or pointed to durable growth, and as a result sentiment toward technology companies that dominate the S&P 500 firmed. Apple shares rallied ahead of the companys quarterly report after traders grew confident that the iPhone 17 family has reignited consumer upgrades, pushing Apple to the rarified four trillion dollar market capitalization club. At the same time Microsoft, buoyed by accelerating Azure revenue and growing AI related demand, crossed the same four trillion dollar threshold, a reflection of how cloud computing and enterprise AI are transforming revenue profiles for large software companies.

The market movement was not merely symbolic. Over the past three months Apple shares climbed strongly on signs of renewed handset demand and optimistic services data, gains that analysts say reflect both product cycle strength and resilient consumer spending. Meanwhile Microsoft posted reported revenue and earnings that outpaced estimates in recent quarters as cloud computing remained a high growth engine, with company executives pointing to enterprise uptake of AI tools as a key driver of future sales and capital spending. Those concrete earnings beats have translated into immediate price reactions in the market and wider confidence among index investors.

Analysts were quick to highlight the mechanics behind the rallies. For Apple the combination of better than expected hardware turnover and a buoyant services business has improved margin visibility and reassured investors about near term revenue growth. For Microsoft the math looks different but is equally compelling. Cloud revenue growth and higher software as a service adoption have lifted the top line and allowed the company to guide infrastructure investments that address surging AI workloads. Together they demonstrate how product cycles and enterprise technology adoption can drive earnings multipliers that influence the entire market.

Market breadth was mixed but the concentration of gains among a handful of mega capitalization names showed how much the market remains tethered to a small group of companies that dominate equity indexes. On days when Apple and Microsoft post upside surprises the headline indexes often follow, because these companies collectively account for a meaningful share of index weighting. That dynamic was visible this week as indexes climbed when the market priced in stronger Apple sales and firmer Microsoft cloud growth and then pared some gains when traders rotated into other cyclicals. In short the earnings led moves show how few large companies still have the power to move broad benchmarks.

Investors also paid close attention to commentary about future spending by corporations and consumers. Executives from Microsoft emphasized that AI driven workloads are producing more predictable enterprise spending patterns and that demand for cloud capacity is expected to remain elevated. Separately market watchers pointed to Apple management signals about product mix and services growth as the reasons the company could sustain margin levels despite macro uncertainty. Those messages mattered because they help shape forward looking estimates that analysts use to value companies, and when the messages are favorable the market responds with higher valuations.

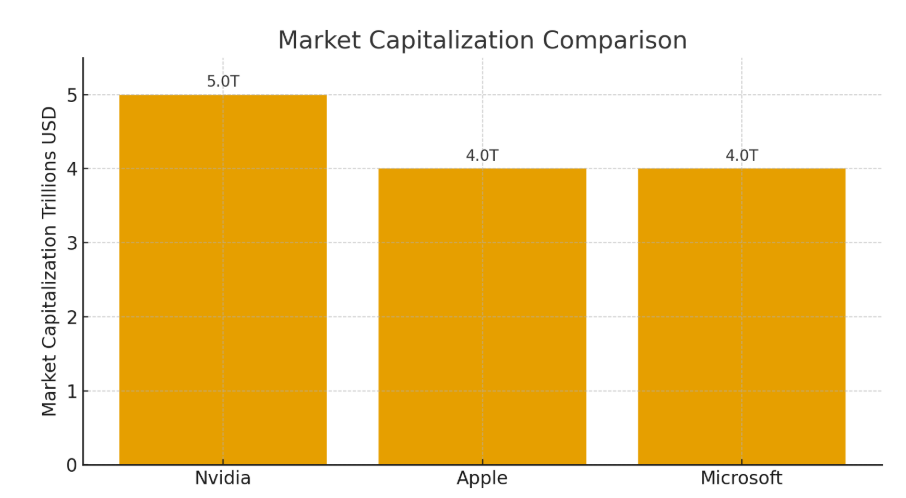

Looking at the numbers highlights why the rallies feel consequential. Apple and Microsoft each reached roughly four trillion dollars in market capitalization as investor enthusiasm for technology intersected with solid earnings execution. By comparison Nvidia has also become a focal point this year, trading at even higher valuations as excitement about AI chips accelerated. The relative scale of these market caps tells a clear story about where both capital and confidence are concentrated today. See the accompanying graphic for a simple comparison of market capitalization among these leaders.

Yet despite the upbeat tone there are cautionary notes. Some strategists pointed out that heavy concentration in a small number of stocks raises questions about market breadth and resilience. If a handful of mega cap names stall the indexes can correct quickly. In addition the path forward for both Apple and Microsoft will depend on how well they translate current momentum into sustainable revenue growth in coming quarters, and whether they can maintain margins amid increased investment in areas such as AI infrastructure or new product introductions. Investors will therefore watch not just headline earnings but management guidance and execution on future investments.

For now the market reaction makes clear that strong earnings can still ignite rallies especially when they validate major secular trends such as cloud adoption and consumer device upgrades. As Apple and Microsoft continue to report results and guide to future quarters markets will gauge the durability of the gains and the extent to which these companies can keep setting the tone for index performance. In the short term earnings season will likely keep volatility elevated but the immediate outcome this week was unmistakable: product strength and cloud driven revenues helped push two of the worlds largest companies to new valuation milestones and in doing so they lifted markets along the way.