Ethereum is on the verge of another major evolution that, proponents say, will deliver faster transactions and lower fees for the millions who use the network every day. The upgrade, widely discussed in developer circles and among institutional watchers, centers on a bundle of protocol changes that together increase data capacity, reduce the cost of posting rollup data, and make running nodes less burdensome. As a result, users and developers are increasingly optimistic that routine payments, games, and social applications will become cheaper and snappier on Ethereum without sacrificing the network security that made it the default settlement layer for decentralized finance.

In concrete terms the recent Pectra enhancements roughly doubled certain data capacity metrics for the base layer and thereby increased transaction throughput from an estimated 210 transactions per second to around 420 transactions per second on comparable assumptions. This gain matters because Layer 2 networks depend on onchain data availability and the more headroom the base layer provides the cheaper rollup transactions become. Meanwhile new protocol features being bundled into the next upgrade aim to expand that headroom further while lowering costs for rollups that post data in the new blob format.

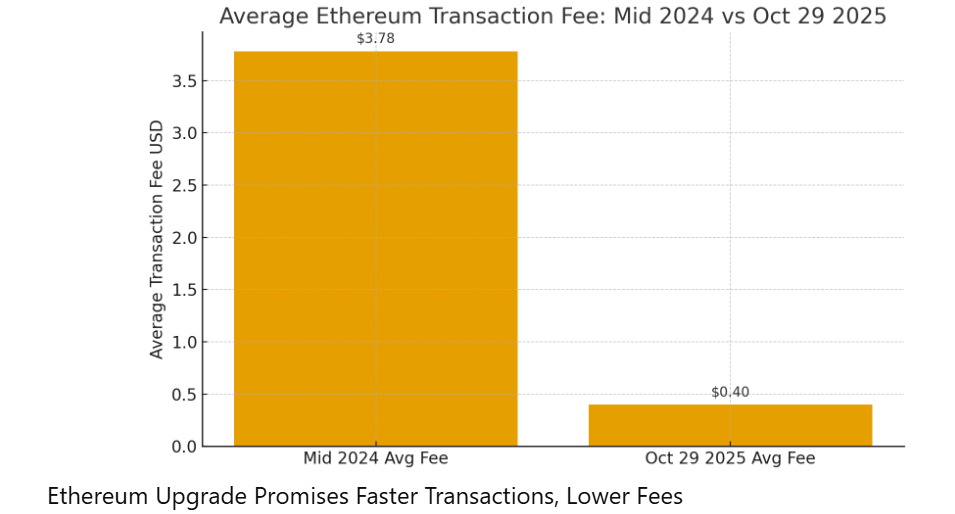

Those technical improvements are already playing out in the numbers. Average onchain transaction fees have fallen dramatically from the highs of the boom years, and recent market trackers put the average Ethereum transaction fee at about forty cents per transaction as of October twenty nine 2025. That figure represents a steep decline from mid 2024 levels when average fees were measured in the dollars and not cents range for routine transfers. Lower fees are not simply cosmetic because they unlock new classes of small value use cases that were previously uneconomical.

READ MORE: Millennials Shift to ETFs as Confidence in Crypto Wanes

Developers and researchers emphasize that the upgrades were engineered with rollups in mind. The introduction of blob gas via proto danksharding during earlier Dencun work created a separate fee market for data posting that is far cheaper than legacy calldata. That change alone nudged many Layer 2 builders to adopt blob friendly flows thereby reducing the per user bill for transactions. Yet limitations remained because initial blobspace allocations capped how much cheaper rollups could get. The latest proposals raise blob capacity while also introducing new data availability mechanisms so that rollups can scale without forcing every node to store ever larger data sets.

Perhaps the most talked about addition to the upcoming upgrade is PeerDAS. Described by key ecosystem figures as a system that lets nodes sample only small chunks of posted blob data while still ensuring overall data availability the approach promises to cut node resource requirements meaningfully. Vitalik Buterin has said that PeerDAS is “the key to layer two scaling” and has framed safety as the core priority while implementing these mechanisms. In practice that means the network can accommodate higher blob counts per block without making it prohibitively expensive for independent node operators to participate.

READ MORE: Apple, Microsoft Drive Market Gains Amid Strong Earnings

Market watchers also point out that these protocol gains are complementary to off chain engineering advances such as more efficient rollup verification and wider adoption of zk based proofs. Put another way as Layer 2 systems improve compression and proof generation the work required onchain per user shrinks further and those savings cascade into lower end user fees. Some analysts even argue that with the combined effect of protocol upgrades and Layer 2 maturity the ecosystem could support orders of magnitude more throughput for everyday activity on rollups while preserving final settlement guarantees on Ethereum mainnet.

Of course the upgrades are not a silver bullet. Observers warn that cheaper fees on Layer 2 could lead to higher overall activity which in turn could increase absolute ETH burned by the base fee mechanism if usage grows faster than per transaction costs fall. In addition the network upgrade process itself requires careful coordination across client teams exchanges and infrastructure providers to avoid service interruptions at activation. That fusion of technical complexity and economic nuance is why developers have spent months of testing on public testnets ahead of mainnet activation dates.

READ MORE: US GDP Growth Beats Expectations, Fueling Rate-Cut Debate

Still many users will notice immediate practical benefits. For ordinary transfers and simple smart contract interactions the combination of higher blob capacity and better node efficiency should translate into lower final costs and crisper confirmation experiences. For developers building applications that were previously priced out by gas costs the upgrades create breathing room to iterate and attract new users. In short the roadmap attempts to preserve Ethereum’s role as the secure settlement layer while letting the user facing experience live on faster cheaper rails.

In the words of several core developers the upgrades are designed to be iterative rather than revolutionary with each step creating more utility for Layer 2 networks while keeping decentralization intact. As a result the most immediate winners may be the millions who transact on rollups each day followed by the ecosystem of builders making infrastructure and wallets that now face a much friendlier cost curve. Looking ahead the community will be watching activation dates testnet results and early mainnet metrics to judge how quickly the theoretical gains show up in everyday user experiences.

READ MORE: Global Stocks Edge Higher as Investors Await Central Bank Decisions