In a major step toward financial inclusion and global connectivity, M-PESA, Africa’s leading mobile money platform, has partnered with Visa to launch the M-PESA GlobalPay Virtual Visa Card — a service designed to enable millions of M-PESA users to make seamless and secure international payments. The launch marks a milestone in Kenya’s fast-growing digital economy and comes at a time when demand for cross-border e-commerce and virtual financial solutions continues to rise across the continent.

The new M-PESA GlobalPay Virtual Visa Card connects directly to a user’s M-PESA wallet, allowing them to transact on international websites and applications that accept Visa payments. This means M-PESA customers can now pay for streaming services, online courses, travel bookings, and global retail platforms such as Amazon, Netflix, and Alibaba — all from their mobile phones. The service aims to bridge the gap between local mobile money ecosystems and the global digital economy, a move that industry experts believe will accelerate financial inclusion and convenience.

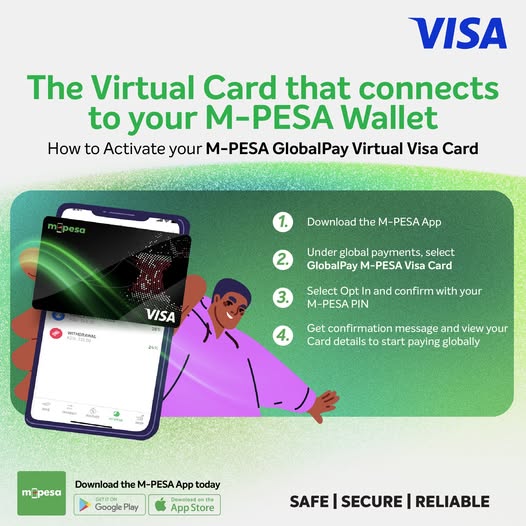

To activate the virtual card, users simply need to download or update the M-PESA app, navigate to the “Global Payments” section, and select the GlobalPay M-PESA Visa Card option. After opting in and confirming with their M-PESA PIN, customers instantly receive a confirmation message and access to their virtual card details. This entire process takes less than two minutes, making it one of the fastest ways to unlock international payment capabilities.

The launch is expected to impact more than 32 million active M-PESA users in Kenya and an estimated 60 million users across Africa. According to data from the Communications Authority of Kenya, M-PESA currently handles over $200 billion (KSh 30 trillion) in transactions annually, underscoring the platform’s significance in the region’s financial ecosystem. The integration with Visa’s global payment network now positions M-PESA as a bridge between Africa’s mobile money users and over 100 million Visa-accepting merchants worldwide.

Digital payment trends in Africa show no signs of slowing down. The continent’s mobile money industry grew by 22 percent in 2023, according to GSMA, driven by increased smartphone penetration and a shift toward cashless transactions. Kenya remains a global leader in this space, with more than 95 percent of adults using mobile money services. The introduction of the M-PESA GlobalPay Virtual Visa Card aligns perfectly with this digital shift, offering users a simple yet powerful way to transact beyond borders.

The partnership also strengthens Visa’s foothold in Africa’s fast-evolving fintech landscape. Visa’s regional leadership team has expressed optimism about the collaboration, emphasizing that it supports Visa’s mission to expand access to the formal financial system for underserved populations.

Security remains a top priority for both partners. The M-PESA GlobalPay Virtual Visa Card uses advanced encryption and tokenization technology, ensuring that customers’ financial details are protected from fraud or unauthorized access. Furthermore, users retain full control of their spending limits, currency preferences, and card settings directly within the M-PESA app. This flexibility gives customers peace of mind while enabling them to track expenses in real-time.

From a consumer perspective, the benefits are clear. For the first time, M-PESA users can subscribe to international services and pay in foreign currencies without the need for a traditional bank account. This democratization of access is particularly crucial for freelancers, students, small business owners, and travelers who previously faced challenges when making international payments. The card also supports payments in multiple currencies, including USD, GBP, and EUR, ensuring convenience for diverse use cases.

Analysts believe this partnership could reshape Kenya’s digital payment landscape. By integrating the world’s most trusted payment network with Africa’s most widely used mobile money platform, Visa and Safaricom are effectively merging two ecosystems — one global, one local — to create a borderless payment experience. As Kenya continues to position itself as a technology and innovation hub in Africa, the M-PESA GlobalPay Virtual Visa Card could play a pivotal role in boosting e-commerce participation and digital entrepreneurship.

The M-PESA GlobalPay Virtual Visa Card is now available on both Google Play and the Apple App Store through the M-PESA app. Customers are encouraged to activate their cards and start enjoying global access today. As M-PESA continues to evolve from a mobile money transfer service into a comprehensive digital financial ecosystem, this partnership with Visa cements its position as a trailblazer in fintech innovation.

With over a decade of transforming how Kenyans send, receive, and manage money, M-PESA is now breaking barriers beyond borders — offering a safe, secure, and reliable pathway to global commerce. The launch of the GlobalPay Virtual Visa Card represents not just a technological achievement, but a powerful symbol of financial inclusion and empowerment across Africa.

M-PESA Partners with Visa to Launch GlobalPay Virtual Visa Card

How to Easily Link PayPal to M-PESA App and Access Your Funds in Kenya

Safaricom Adds PayPal Withdrawals to M-PESA App to Woo Kenya’s Remote Workers